Should I Invest When the market is Down?

While there are businesses that have been thriving during the COVID-19 crisis, some have been adversely impacted by the public health containment measures, which have resulted in shortened working hours and business opening hours, resulting in a constraint on corporate earnings and increased unemployment. With these unrelenting challenges brought on by the pandemic, financial markets are currently unstable, causing increased concern and even greater caution among investors regarding their financial future.

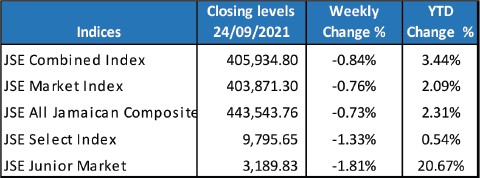

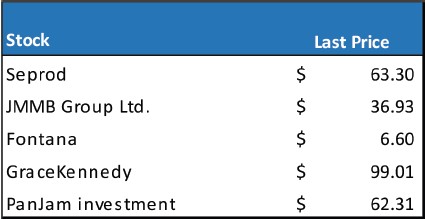

The stocks on the main market of the Jamaica Stock Exchange have fallen sharply since the onset of the pandemic, and many investors are worried since they are uncertain when there will be a resurgence in the main market stock prices to the pre-pandemic levels. This downturn is concerning to investors because the main market contains the stocks of the more established companies, and these companies have a significant influence on the performance of the market as a whole. The fall in the prices of these more established companies have had a negative impact on the sentiment of the stock market. No one knows for certain whether a market rally is on the horizon or not. But if the market doldrums continue, should you continue to invest? Here is what you need to know.

What happens when the stock market crashes?

Downturns in the stock market can be worrisome, but since fluctuations in stock prices are normal, sooner or later the market may experience a downturn. A market downturn or a market crash happens when there is a sharp decline in stock prices. This sharp price decline usually occurs over a short period of time. For instance, you might have a 30% or 50% decline in the particular market index over a one week, or a one month period and market prices may remain at these low levels for a protracted period of time, sometimes spanning several years. Historically, the stock market has recovered from each downturn it has ever experienced. Let’s consider, that you own 100 shares of a stock that you bought for $10 per share. Your investment is worth $1,000. If the market crashes and the stock price falls to, say, $5 per share, your investment is now only worth $500. If you were to sell your shares at that moment, you’d lose $500. However, if you wait until the market recovers and the stock price again reaches $10 per share, your investments will once again be worth $1,000 and you would not have lost any money. Hence, a loss on paper does not amount to a real loss or realized losses if you never actually sell the stock or fund. This means that unless you sell your investments in a crash, you will not lose any money. Therefore, if you remain invested during periods of volatility, you will most likely make it through to the market recovery.