Using Stocks to Protect your Portfolio against Inflation

Have you noticed that things are costing more nowadays? Common goods like lumber, gasoline, auto parts, and grocery items such as bread and vegetables have seen prices rise this year as a result of rising inflation. Inflation tracks the rise in the price of goods and services. Higher prices for fuel, electricity and food items drove much of this increase in inflation. The inflation rate in Jamaica, or the rate at which prices are increasing, was at 6.1% in August; its highest in six years, and businesses are expecting it to continue climbing even higher over the next three quarters.

What should an investor do when there is an upsurge in inflation? Often, it means adjusting investment portfolios to protect assets against rising prices and an uncertain economy.

The Impact of Inflation on Your Portfolio

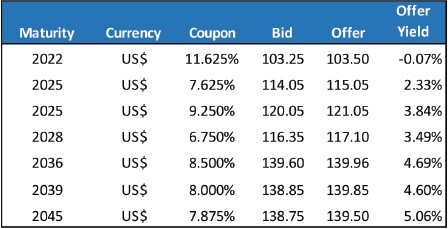

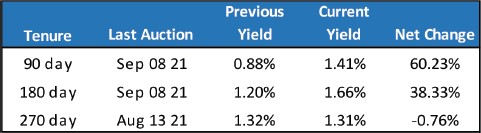

Should you be concerned about inflation and your investments? If you have a significant portion of your investments in fixed income securities, then you should definitely be concerned.

When inflation rises, consumer prices rise with it. When prices are increasing, your money will purchase less goods and services. This is especially so for retirees or persons who invest mostly in fixed income. You pay more for less, so retirees on a fixed income suffer when their nest eggs buy less each passing year. For this reason, financial advisors generally caution to keep some portion of your assets in the stock market, to safeguard against inflation.

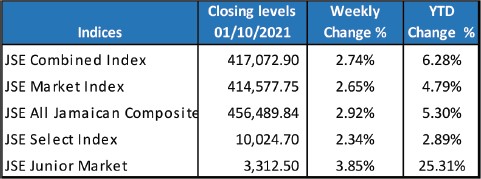

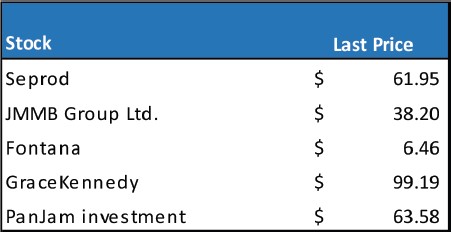

Stocks that offer protection against Inflation

Stocks, as mentioned earlier, tend to beat inflation even though their growth might be slowed. With that said, investors can choose to ballast their portfolio against inflation by buying individual stocks or buying units in pooled equity funds such as unit trusts or mutual funds.

While some companies can react to inflation by raising their prices, others which compete in the global market may find it difficult to stay competitive with foreign producers that do not have to raise prices due to inflation. On the other hand, some stocks can perform well in periods of high inflation and for these companies, rising prices contribute to higher revenues, which help to boost the price of a company’s stock.